All Categories

Featured

Table of Contents

If you pick degree term life insurance, you can budget for your costs since they'll remain the same throughout your term (Best level term life insurance). And also, you'll know exactly just how much of a fatality benefit your beneficiaries will certainly get if you pass away, as this amount won't change either. The prices for level term life insurance will certainly depend on numerous aspects, like your age, health and wellness status, and the insurer you select

As soon as you experience the application and clinical test, the life insurance coverage firm will examine your application. They need to educate you of whether you've been approved soon after you use. Upon approval, you can pay your very first costs and sign any appropriate documentation to ensure you're covered. From there, you'll pay your costs on a regular monthly or yearly basis.

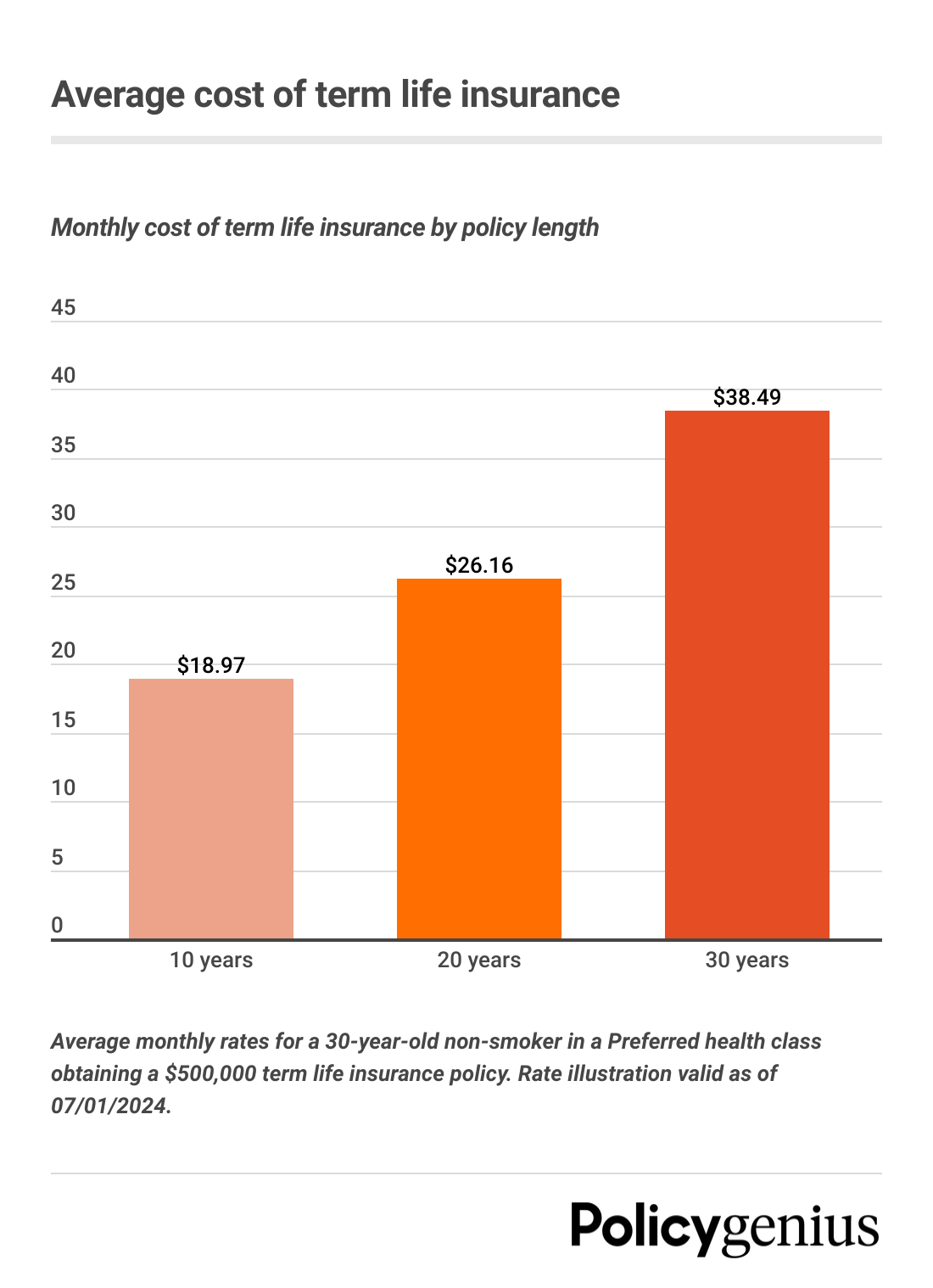

Aflac's term life insurance policy is practical. You can pick a 10, 20, or 30 year term and appreciate the included peace of mind you are worthy of. Collaborating with an agent can help you discover a plan that functions ideal for your demands. Discover more and get a quote today!.

This is no matter of whether the guaranteed individual dies on the day the plan begins or the day prior to the plan finishes. In various other words, the amount of cover is 'level'. Legal & General Life Insurance Coverage is an example of a degree term life insurance coverage plan. A degree term life insurance policy can suit a large range of scenarios and needs.

What is the process for getting No Medical Exam Level Term Life Insurance?

Your life insurance plan could also form part of your estate, so might be based on Inheritance Tax found out more about life insurance coverage and tax. Allow's check out some features of Life insurance policy from Legal & General: Minimum age 18 Maximum age 77 (Life Insurance), or 67 (with Essential Ailment Cover).

The amount you pay remains the very same, yet the level of cover lowers roughly in line with the method a settlement home mortgage decreases. Decreasing life insurance policy can help your loved ones stay in the family members home and prevent any type of additional disruption if you were to pass away.

Term life insurance supplies protection for a certain amount of time, or "term" of years. If the insured person passes away within the "term" of the plan and the policy is still in force (active), then the fatality advantage is paid out to the recipient. This sort of insurance policy commonly permits customers to initially acquire more insurance coverage for less money (premium) than various other sort of life insurance policy.

How do I apply for Level Term Life Insurance Premiums?

Life insurance acts as a substitute for revenue. The possible threat of losing that gaining power earnings you'll require to fund your family's most significant objectives like acquiring a home, paying for your children' education, minimizing debt, saving for retirement, and so on.

One of the main charms of term life insurance policy is that you can get even more insurance coverage for much less cash. However, the coverage expires at the end of the plan's term. An additional way term policies vary from entire life or long-term insurance policy is that they commonly do not develop cash money value gradually.

The theory behind lowering the payment later on in life is that the insured anticipates having actually decreased insurance coverage demands. You (ideally) will owe less on your home mortgage and other debts at age 50 than you would at age 30. As an outcome, you could choose to pay a reduced premium and reduced the quantity your recipient would certainly obtain, due to the fact that they wouldn't have as much debt to pay in your place.

How can I secure Fixed Rate Term Life Insurance quickly?

Our plans are developed to complete the spaces left by SGLI and VGLI plans. AAFMAA works to understand and sustain your special financial goals at every phase of life, tailoring our solution to your special scenario. online or over the phone with one of our armed forces life insurance policy professionals at and find out more about your armed forces and today.

With this kind of protection, costs are thus assured to remain the very same throughout the agreement., the amount of insurance coverage supplied rises over time.

Term policies are additionally frequently level-premium, yet the overage quantity will certainly remain the exact same and not grow. One of the most common terms are 10, 15, 20, and thirty years, based on the demands of the insurance policy holder. Level-premium insurance policy is a kind of life insurance policy in which premiums remain the same rate throughout the term, while the quantity of insurance coverage provided boosts.

For a term policy, this implies for the size of the term (e.g. 20 or 30 years); and for a long-term plan, up until the insured passes away. Over the lengthy run, level-premium payments are commonly much more economical.

What is the most popular Level Term Life Insurance For Young Adults plan in 2024?

They each look for a 30-year term with $1 million in protection. Jen buys an ensured level-premium policy at around $42 monthly, with a 30-year perspective, for an overall of $500 each year. However Beth figures she might just require a prepare for three-to-five years or until full settlement of her present financial debts.

In year 1, she pays $240 per year, 1 and about $500 by year five. In years 2 with 5, Jen proceeds to pay $500 monthly, and Beth has paid approximately just $357 per year for the very same $1 million of protection. If Beth no much longer needs life insurance policy at year five, she will certainly have conserved a great deal of cash loved one to what Jen paid.

Every year as Beth grows older, she encounters ever-higher yearly costs. Meanwhile, Jen will certainly remain to pay $500 each year. Life insurance providers are able to offer level-premium plans by essentially "over-charging" for the earlier years of the policy, collecting even more than what is required actuarially to cover the risk of the insured passing away throughout that early period.

1 Life Insurance Policy Stats, Information And Market Trends 2024. 2 Cost of insurance coverage prices are figured out using approaches that differ by company. These rates can differ and will normally raise with age. Rates for energetic employees may be various than those readily available to ended or retired workers. It is very important to take a look at all factors when evaluating the general competitiveness of prices and the worth of life insurance coverage.

Is 20-year Level Term Life Insurance worth it?

Like many group insurance coverage plans, insurance policy policies provided by MetLife contain particular exclusions, exceptions, waiting periods, decreases, constraints and terms for keeping them in pressure. Please contact your benefits administrator or MetLife for expenses and full information.

Table of Contents

Latest Posts

Aig Final Expense Insurance

Funeral Burial Insurance Policy

Funeral Coverage

More

Latest Posts

Aig Final Expense Insurance

Funeral Burial Insurance Policy

Funeral Coverage