All Categories

Featured

Table of Contents

Insurance firms won't pay a small. Rather, consider leaving the money to an estate or count on. For more comprehensive details on life insurance coverage obtain a copy of the NAIC Life Insurance Policy Purchasers Guide.

The IRS places a limitation on exactly how much cash can go right into life insurance policy costs for the policy and just how quickly such premiums can be paid in order for the policy to retain all of its tax benefits. If particular limits are exceeded, a MEC results. MEC policyholders might undergo taxes on distributions on an income-first basis, that is, to the extent there is gain in their plans, along with fines on any type of taxable quantity if they are not age 59 1/2 or older.

Please note that impressive lendings build up passion. Revenue tax-free therapy likewise presumes the financing will at some point be pleased from earnings tax-free fatality advantage proceeds. Lendings and withdrawals decrease the plan's cash worth and survivor benefit, might create particular policy advantages or riders to end up being inaccessible and may boost the opportunity the plan might lapse.

A customer may certify for the life insurance policy, but not the motorcyclist. A variable universal life insurance coverage agreement is an agreement with the key objective of offering a death advantage.

How much does Senior Protection cost?

These portfolios are closely managed in order to satisfy stated investment purposes. There are charges and charges related to variable life insurance policy agreements, including death and danger charges, a front-end load, administrative charges, investment monitoring costs, abandonment charges and costs for optional riders. Equitable Financial and its affiliates do not give lawful or tax suggestions.

And that's terrific, since that's specifically what the death benefit is for.

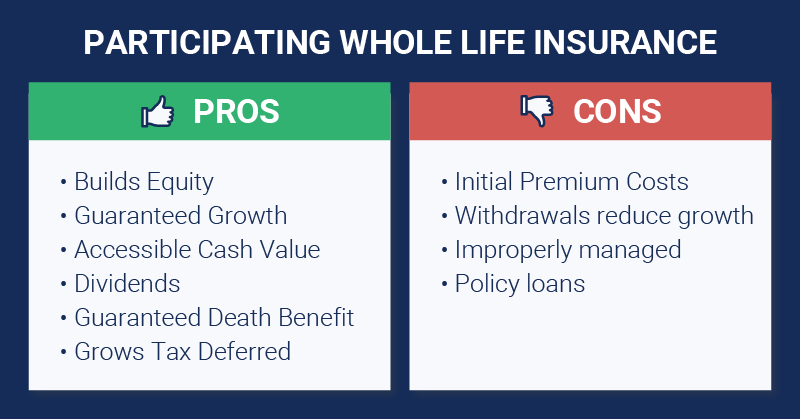

What are the advantages of entire life insurance policy? Here are some of the vital points you need to know. Among the most attractive benefits of acquiring an entire life insurance coverage plan is this: As long as you pay your costs, your death advantage will certainly never ever run out. It is guaranteed to be paid no matter of when you die, whether that's tomorrow, in five years, 80 years or perhaps additionally away. Term life.

Think you do not require life insurance policy if you do not have children? You might desire to reconsider. It might appear like an unnecessary expenditure. However there are lots of advantages to living insurance coverage, even if you're not sustaining a family members. Here are 5 reasons you ought to purchase life insurance policy.

How do I apply for Trust Planning?

Funeral costs, funeral expenses and medical costs can accumulate (Premium plans). The last point you want is for your enjoyed ones to shoulder this added worry. Irreversible life insurance policy is readily available in numerous quantities, so you can pick a survivor benefit that meets your needs. Alright, this one only uses if you have youngsters.

Determine whether term or irreversible life insurance policy is right for you. Obtain a price quote of exactly how much coverage you might require, and just how much it can cost. Discover the correct amount for your budget plan and comfort. Find your quantity. As your individual situations modification (i.e., marriage, birth of a youngster or work promotion), so will certainly your life insurance needs.

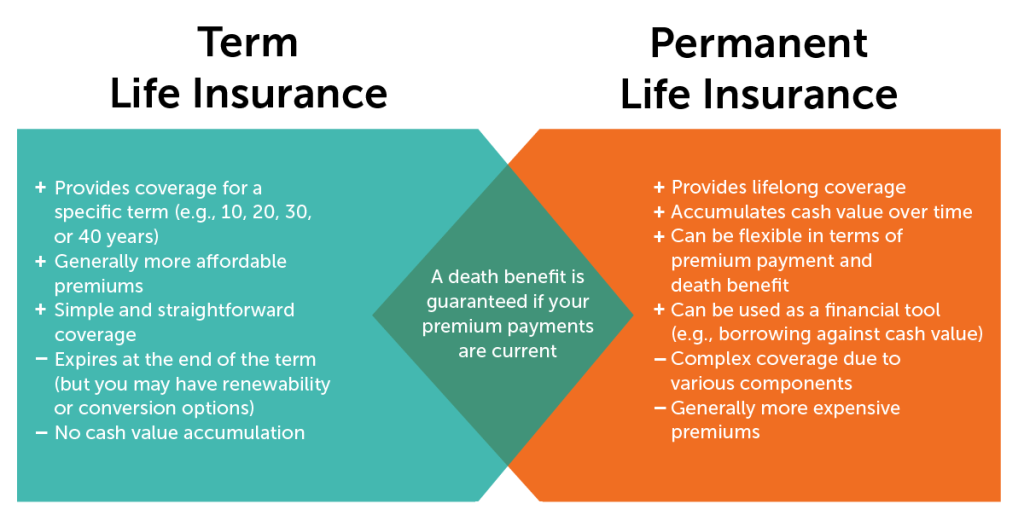

For the a lot of component, there are two types of life insurance policy intends - either term or permanent strategies or some combination of both. Life insurers provide numerous forms of term strategies and standard life policies in addition to "rate of interest sensitive" products which have actually ended up being more prevalent given that the 1980's.

Term insurance policy offers protection for a specific period of time. This duration might be as short as one year or give insurance coverage for a specific variety of years such as 5, 10, twenty years or to a defined age such as 80 or in some instances up to the earliest age in the life insurance policy death tables.

Wealth Transfer Plans

Currently term insurance policy prices are really affordable and amongst the cheapest traditionally seasoned. It ought to be kept in mind that it is a widely held belief that term insurance policy is the least pricey pure life insurance protection readily available. One needs to evaluate the policy terms meticulously to determine which term life alternatives appropriate to satisfy your specific conditions.

With each new term the costs is raised. The right to renew the policy without proof of insurability is an important advantage to you. Otherwise, the threat you take is that your wellness may deteriorate and you might be incapable to get a policy at the exact same rates or also at all, leaving you and your recipients without insurance coverage.

You need to exercise this choice throughout the conversion period. The size of the conversion period will differ relying on the kind of term plan acquired. If you convert within the prescribed period, you are not called for to give any kind of info regarding your health and wellness. The premium price you pay on conversion is typically based upon your "current attained age", which is your age on the conversion date.

Under a degree term plan the face amount of the policy remains the very same for the whole period. With lowering term the face amount decreases over the period. The premium remains the exact same every year. Usually such plans are offered as mortgage security with the amount of insurance lowering as the balance of the mortgage reduces.

What is the process for getting Term Life?

Typically, insurance companies have actually not can change costs after the policy is marketed. Given that such plans might proceed for years, insurance firms need to utilize traditional death, rate of interest and cost price quotes in the premium estimation. Adjustable costs insurance, however, enables insurance providers to supply insurance coverage at reduced "current" costs based upon less conventional assumptions with the right to change these costs in the future.

While term insurance coverage is developed to supply security for a defined period, irreversible insurance is made to give protection for your entire lifetime. To maintain the costs price degree, the premium at the younger ages goes beyond the real price of security. This additional premium builds a get (money worth) which aids pay for the policy in later years as the cost of security rises above the premium.

The insurance coverage firm invests the excess premium bucks This kind of policy, which is occasionally called cash money worth life insurance coverage, generates a financial savings element. Cash values are crucial to a permanent life insurance coverage policy.

Table of Contents

Latest Posts

Aig Final Expense Insurance

Funeral Burial Insurance Policy

Funeral Coverage

More

Latest Posts

Aig Final Expense Insurance

Funeral Burial Insurance Policy

Funeral Coverage